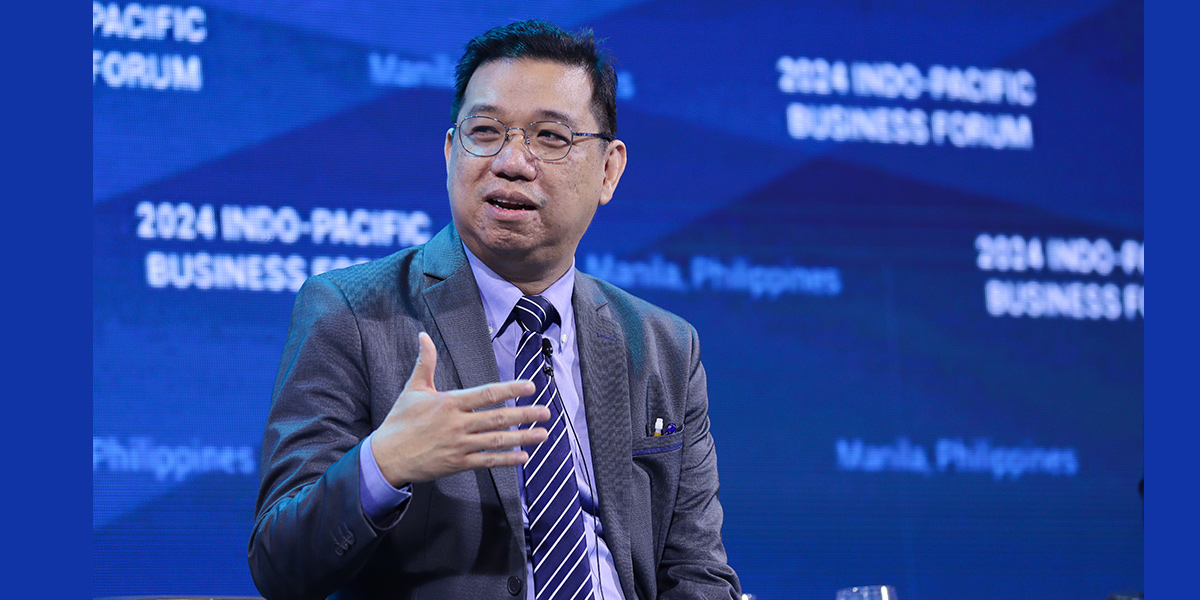

25 Oct Interview with Mr. Ceferino S. Rodolfo, Managing Head of Philippines Board of Investments (BOI)

Investment approvals at the Board of Investments reached $22 billion last year, suppressing the pre-pandemic level and making a new record for Board of Investment approvals. What investments have contributed to this achievement?

It’s the highest in our 56 years of history. What is noteworthy is that it’s in the sectors that are transforming the Philippine economy, most notably in renewable energy, data centers and third-party telco towers. These sectors make us more sustainable and more digitally connected. Our track record and mandate are to lead the way in developing these very strategic sectors.

In the last three months, we have seen a huge increase in investments in the Philippines. November 2023, compared with November 2022 we have increased by 28%. In December, we increased by 30%. In January, we’ve increased by 90%. Most of these have been going to the manufacturing sector, particularly from Japan and the US and then increasingly coming from Europe.

BOI offers tax incentives to both local and foreign investors. What are these fiscal incentives and how do they play a role in attracting foreign investors?

The basic structure of the incentive is that it features an income tax holiday that runs from four to seven years. The further you are from Metro Manila and the higher the technology that is embedded in your project, the longer the incentive availability period. Plus, if you are export-oriented, you would be allowed 10 years of special corporate income tax of just 5% tax on the gross income earned. For example, we can offer up to 50% additional deduction on your cost related to power. On top of the power cost, you can be allowed a 50% additional deduction from your taxable income. For costs related to power for training, it is 100%; for labor, it is 100%; for locally procured materials, it’s 50%; for R&D it’s 100%.

If the project will breach $1 billion or will employ more than 10,000 workers, the government has been authorized to negotiate with the investor for up to 40 years of the incentive period, consisting of eight years of income tax holiday and 32 years of the lower corporate income tax or enhanced deduction.

What is the BOI focusing on with the recently approved projects? How are you involved in renewable energy?

We have approved 59 companies in renewable energy. The focus is to accelerate the implementation period of renewable energy projects because most of these are in two particular areas. Number one, offshore wind projects. The second one is on the floating solar projects. We are quite lucky that in the Philippines, what used to be considered a disadvantage in terms of our geographic configuration now it’s turning out to be an advantage for renewables. It’s a disadvantage because of logistics compared to countries that are in mainland and Southeast Asia where it’s very easy to be connected by rail, for example. We are disconnected here in this part, but we are centrally located, especially if you talk about the US mainland Asia, the Philippines and East Asia.

Another disadvantage of the Philippines before is that we are in the Pacific Ring of Fire, which makes us susceptible to earthquakes and volcanic eruptions. But it turned out that precisely because of this, we have the green metals, the minerals that are so much in demand in the world as we transition to a more sustainable future. We are rich in nickel, copper and cobalt that you need for batteries and electric vehicles. For example, a typical electric vehicle would have 80 kilograms of copper while an internal combustion engine vehicle would have 40 kilograms. In the Philippines, we are rich in copper and we are number one when it comes to wiring harnesses. Right now, there have been companies investing in facilities for high-voltage wiring harnesses. Since Indonesia banned the export of nickel ore, we are now the number one source of nickel ore globally. China, which is by far the world’s largest producer of batteries, is dependent on us for about 89% of the nickel ore that it imports in terms of volume, maybe 80% in terms of value.

Our objective is to process the nickel here and hopefully invite investments in the processing so that we do not export nickel in ore form. In a recent Bloomberg article, a US government official said that they are coordinating and cooperating to have processing here because countries would like to secure more resilient supply chains, including electric vehicles, data centers, submarines and militaries. Right now, some countries are thinking that the battery supply chain is too focused on China and they would like to diversify a bit. A good starting point would be where the nickel is coming from and it’s coming from us.

What specific technologies is the BOI developing in digital infrastructure and how much are you investing?

We do not invest by ourselves, but we try to attract investments in this area. There is a cycle of two to three years where strategic investments become the highest priority sectors of the Philippines. Right now, you would see that more is in renewable energy, data centers and Telco towers. Two or three years ago it was in data centers, a few years before that, it was on the telco towers.

There is a close connection between the policy changes and the inflow of investments. For example, what has driven investments in telco towers has been the decision of the Philippine government to move towards third-party ownership of shared telco towers, whereas before the telco companies that dominate would own the telco tower. The government said it has to be a third-party-owned telco tower and then shared with whoever would like to lease the telco Tower. That has driven investments into this sector.

Some of the big investments that have come in have also been from North America. Most of the data centers before had been going to Singapore but the hyper-scale data centers have committed to certain carbon footprint thresholds. In Singapore, they have already breached that. So, they’re looking for other areas where they can expand further and the Philippines is one of those areas.

Our main differentiation is that for the data centers that are put up here, we’d like them to be renewable and energy-empowered. They also have to put up their renewable energy facilities. We see that the whole importance that the world is giving to sustainable energy and net zero carbon commitment is a game changer for us because it levels the playing field. In this particular case for data centers, we’d like the data centers to be there as a way to empower further development of our renewable energy. Data centers would also be putting up solar power projects.

The government allows 100% foreign ownership of renewable energy projects especially on wind, solar and tidal. The president announced this policy when he visited Brussels in December 2022. The other policies that we have benefited from would be the public service amendment that allowed for 100% foreign ownership of telecoms, including other sectors. That has, for example, allowed the entry of SpaceX Starlink into the lower earth orbit satellite space.

What opportunities are available for foreign investors from the US and which sectors in the country do you consider good assets for those investors?

The US is unique. First, there are industries where they are investing indirectly. For example, in telcos or SpaceX Starlink. We have become the second country after Japan in Asia where the low earth orbit satellite service is being provided by some other sectors like data centers and subsea submarine cables by Google is very important.

Big American investors have also acquired the former Hanjin shipyard facility in Subic, by Cerberus. In addition to this, the US in terms of manufacturing has also been relying a lot on subcontractors or its network of supply chain collaborators within the region. In particular, those in East Asia like China, Taiwan, South Korea and Japan. We have also been getting a lot of manufacturing facilities from these countries who would like to further expand and diversify their supply chain base in the manufacturing sector.

As the managing head of BOI, what are your long-term priorities for shaping foreign direct investment here in the Philippines?

We are working on the ease of doing business. That’s why we have the Green Lane Project hand holdinginvestors to go here. The second one is in terms of promoting opportunities here, in particular for the priority sectors anchoring it on positioning the Philippines as the hub for smart and sustainable manufacturing.

Sorry, the comment form is closed at this time.